JULY 2021 Market Report

Investment Review

During the one-month period to 30th June, major equity markets, as measured by the aggregate FTSE All – World Index rose slightly. The NASDAQ Index was the only significant upward mover amongst the major markets, while Japan and certain emerging markets were relatively weak. The VIX index fell further to a level of 15.98 a fall of 29.8% from the year end. Government Fixed Interest stocks, rose slightly in price terms, mainly following the recent Fed meeting, the US 10 year for instance, closing the month at a yield of 1.44%, while the UK Government All Stocks Index climbed to a level of 182 up 0.7% on the month, though still down 6.7% since the year end. Other bonds also rose slightly. The US Dollar strengthened against major crosses, cable closing the month at 1.381, for example. Oil was one of the few commodities which showed a price gain over June, a stronger dollar, renewed Covid concerns, and certain Chinese moves contributing to weakness elsewhere. Crypto currencies continued their volatile price paths during a month of generally tougher regulation/rhetoric.

In terms of global economic data, there have again been increases to 2021 aggregate forecasts, largely driven by USA and China, but also more encouraging projections for Europe and the UK. The World Bank produced a January forecast of 4% 2021 world economic growth, followed by the OECD estimate of 5.6% 2021 growth, published mid-March. The IMF in its mid-April report predicts 6% global growth this year falling to 4.4% in 2022 but highlights the considerable regional variation. COVID-19 developments during the month featured firstly an accelerated roll out of the key vaccines, but also high levels of cases and deaths in India, parts of Europe and Latin America, localised breakouts in Asia/Australia and the emergence of more virulent strains, very evident in UK infection data. Uneven vaccination rates and levels of lockdown stringency (enforcement and adherence) continue to influence government support measures and Central Bank actions. The BIS cautioned that developed market economic growth would outsrip emerging economies for the first time in many years.

One sobering thought is that, at the time of writing, a small percentage of the world ‘population have received a vaccine of any sort. The chances of reaching global herd immunity before late next year appear small and, of course, if the virus remains rife, the risk of dangerous variants emerging remains high.

Recent US Federal Reserve meetings have reiterated the adoption of the new monetary policy strategy that will be more tolerant of temporary rises in inflation, cementing expectations that the US central bank will keep interest rates at ultra-low levels for an extended period, as well as maintaining bond purchases. However, at the June meeting, a slightly more hawkish tone emerged, along with Fed 2021 economic projections of 7% and 3.3% for GDP growth and inflation, respectively. Recently announced inflation indicators showed the PCE to end May rising at 3.4% over the year, the biggest increase for 29 years. House prices to the end of April were rising at an annual rate of nearly 15%, the largest increase for 30 years according to Case Schiller data. Independent economic forecasts are now expecting over 6%-8% GDP growth for full year 2021 with unemployment ticking down to around 4.5%. The economic debate is now shifting to Biden’s latest plans covering infrastructure, research and development, clean energy, education, and social programmes, as well as longer term tax raising measures (corporation tax, capital gains tax, selective higher income tax etc).

At the ECB December meeting the emergency aid programme was increased, and the 1.8 Trillion Euro loan approved. More details, at national level on the disbursement of these funds have recently emerged from the larger countries. Recent ECB meetings have seen interest rates maintained at -0.5% and a continuance of the pandemic bond buying programme, a subject of growing debate. Very recent European sentiment surveys have pointed to a varying but generally positive trends from for April, May and June (see graph below) , after the widely expected first quarter economic decline., with the area currently expecting to have at least 70% of the population partially vaccinated by Q3 2021. The EU commission currently expects 4.4%-4.8% economic growth this year. June Eurozone inflation stands at 1.9 % and surveys suggest that many companies are likely to pass more factory gate price increases to consumers as the year progresses. On the political front, a relatively quiet period although appointment of new German chancellor this autumn, and the French parliamentary elections (main parties receiving shocks recently) next year will receive increased attention going forward. Stefan Lofven, Sweden’s Prime Minister lost a confidence vote and is currently trying to patch together a viable coalition.

Asia excluding Japan, led by China (across all sectors and property), continues to remain in reasonable economic shape although the recent news flow has been dominated by Indian Covid issues, minor virus outbreaks elsewhere, new Vietnamese variant, Taiwan specific semi-conductor developments and growing Hong Kong tension.

There have been no major changes to Chinese economic forecasts with estimates of 5% to 7% GDP growth overing most of the 2021 projections. Producer prices rose at 6.8% in May, much higher than expected. The spring 2021 National People’s Congress placed emphasis on green policies, urbanization, and scientific research, while today marks the 100th birthday of the Chinese Communist Party.Defiant words re Taiwan were issued.

While there have been no major changes in Japan’s economic trajectory, Yoshihide Suga has suffered a setback in his first electoral test as Japanese PM after opposition parties won a string of victories in by-elections across the country, and the outlook for the coming Olympics is not certain. The most recent BOJ meeting left interest rates unchanged, while the monthly inflation figure ticked into positive territory after months of declines. At corporate level however, shareholder activism is rising and some of the undoubted value in the market is being unlocked by private equity and other transactions. The recent Toshiba AGM highlighted the mood towards better levels of corporate governance.

Within the UK, official GDP figures showed a 9.9% GDP decline in 2020, the worst performance in the G7, and a 1.5% decline over the first quarter of 2021, mainly weighted towards January. More recent PMI figures sentiment indicator and other real time data points suggest that the second quarter has seen sharply accelerating growth. Unemployment remains around 5% and hiring has picked up, with indeed labour shortages in some areas. However, business failures are increasing (Source: Begbies), the rent “holiday†is due to end, Brexit difficulties linger (European trade, farming, fisheries,entertainment), many emergency loans are up for repayment, and the Furlough scheme wind-down may provide headwinds over coming months.

The Treasury’s average of forecasts suggests that the economy will grow by 4.4% this year and 5.7% in 2022.The average of leading independent economists now expect growth of 5.5% for 2021 (see graph), with some estimates as high as 8%. This would be the fastest rate of growth since 1989, and any expansion above 6.5% would be the strongest since the second world war.

Forward looking economic growth estimates cover a wide range, as the positive argument of relief/catch up spending, by an element of the population from records savings (16.1% estimated by ONS for Q4 2020) has to be balanced against rising bankruptcies, unemployment(4.8% latest unemployment rate), greater poverty, loan repayments and the spectre of higher taxes, and certain residual Brexit negatives (e.g. trade admin, tourist travel, financial services, EU defence, pharmaceutical co-operation, airline shareholder voting structure, Scottish/Irish future…).

Inflation, currently 2.1% year-on- year, is likely drift higher in coming months, partly the basis effect, but also utility bills, council tax, fuel prices, while the strong climb in house prices, fuelled at least partly by the temporary stamp duty relief, is widely expected to moderate. The IHS MARKIT/Cips PMI index for June reported rapid increases in input and output cost inflation, the former rising now for five consecutive months.

The Chancellor’s March budget centred on the “Jobs now, tax later†theme and received relatively small market and media reactions. Several muted tax adjustments which could have affected portfolio investment were omitted while the well flagged corporation tax increase from 19% to 25% only takes effect after April 2023.

Provisional government borrowing figures for the financial year 20/21 show a figure of approximately £330 billion, which while lower than some estimates, was still over14% of GDP, close to the percentage level reached at the end of the Second World War. Recent monthly figures, to end May, show a better-than-expected trend, though debt levels are still extremely high in absolute terms.Expect tension between Sunak and Johnson regarding the pension “triple lockâ€, where a statistical quirk is going to have costly consequences.

The June MPC meeting signalled no change interest rates and an unchanged QE policy, calming some inflation hawks, but increasingly at odds with several independent forecasters and retiring member Andy Haldane.

Although currently further from investor worries, growing concerns regarding global trade tensions (many), government debt (over 100% Debt/GDP), USA/China/Iran/Taiwan/Belarus/North Korea/Russia/Australia/Hong Kong/Ukraine, Middle East relations, BREXIT follow up and possible taper tantrums. It will be increasingly important to watch inflation trends, as any “shock†necessitating greater than forecast bond yields could have serious repercussions for many asset classes.

More intangible in nature, the pandemic also seems certain to amplify global inequalities (regional, medical, employment, poverty, demographic) which could manifest in growing social unrest. Recent surveys by CSFB (millionaires) and house price trends on both sides of the Atlantic (ONS,NAR and ECB) provide statistical evidence of the above bifurcation.

Monthly Review of Markets

Equities

Global Equities showed a small positive performance over June 2021, the FTSE ALL World Index registering gains of 1.4% in local currency and 4.2% in sterling adjusted terms. The NASDAQ was one of the leading performers as interest returned to technology and away from certain reflation trades. Japan and certain emerging markets excl China were relatively weak, some declining in absolute terms. The FTSE and FT All-Share both showed negligible monthly movement, the former now showing a six month gain of 8.9% since the beginning of the year. Europe and America lead the gains in local currency and sterling adjusted terms while Japan and Emerging markets lag the average. The VIX index, ended the month at 15.98, a monthly fall of 4.7%.

UK Sectors

There were mixed UK sector performances during June with a near 15% difference between the best and worst performing index sub-indices. Oil and Gas, Pharmaceuticals and Non-Life Insurance stocks outperformed while Mining, Banks and Life Assurance sectors all fell over 7% in absolute terms. Over the quarter Pharmaceutical shares lead the sector performance, helped in part by the Glaxo strategy meeting, while Travel and Leisure names have underperformed from high levels, on varying lock down developments. Since the beginning of the year, smaller company funds have significantly outperformed equity “income†funds which have moved broadly in line with the “average UK fund.â€. A similar trend is evident with European and American funds. Mixed asset funds have shown growth of between 2% and 7%, depending on the equity weight, since the beginning of the year (Source Trustnet 30th June 2021).

Fixed Interest

Gilt prices rose during the month, the UK 10-year yield for instance finishing the month at 0.72%. Other ten-year government bond prices showed marginal price gains with closing ten-year yields of 1.44%, -0.21% and 0.05% in USA, Germany, and Japan respectively. Year to date, the UK Government All-Stock Index has fallen 6.63% Corporate bonds also rose slightly over June in price terms as did more speculative grades. Interestingly, in my view anyway, US speculative debt, emerging market bonds and UK shares all yield about 4.5% at this time of writing. Draw your own conclusions! All the followed core preference shares have significantly outperformed core government stocks in capital and income terms over the year to date and are still recommended if seeking fixed interest exposure with annual yields in the 5.3%-6% area or 10.3% for the more speculative idea. Recently issued convertible bonds, especially in the tech sector are nursing sharp investor losses, suffering a triple whammy in the negative sense!

Outliers or?

Check my recommendations in preference shares (note recent FCA/Aviva “apologyâ€), corporate bonds, floating rate bonds, zero-coupons, speculative high yield etc. A list of my top thirty income ideas from over 10 different asset classes is also available to subscribers.

Foreign Exchange

Dollar strength was one of the monthly features £/$ for example moving to 1.381 and Dollar/Euro to 1.186.

Amongst other currencies, more hawkish interest rate noises/actions from the likes of Canada, Norway, and very recently New Zealand are starting to be reflected in certain cross rates.

China’s currency is hovering near its strongest level against the dollar in three years, posing a challenge for Beijing as it seeks to balance demand for the country’s exports with surging commodity prices. In sterling adjusted terms the American, UK and Continental European markets are significantly outperforming Japan. It is still recommended that at least some of the Japanese exposure is hedged e.g IJPH.

Commodities

A very mixed month for commodities (see graph below) which were buffeted by US Fed meeting, more Covid variant/lockdown worries, Chinese “calming measures†and OPEC/IEA forecasts. Oil and related, iron ore and aluminium showed price gains but there were many fallers e. g copper and gold/precious metals. Since the beginning of the year, however, commodities,with the exception of gold(-6%),have had a very strong year with many price gains between 20% and over 50% (WTI oil)

Looking Forward

Notwithstanding the large human toll and uncertainly still posed by Covid-19 (lockdowns, geographical variations, vaccines) there is growing optimism regarding the course of the global economy.

Central banks generally continue to adopt an easy money policy, supplemented by other measures while Governments provide increasing short- and long-term fiscal support.

However, both supports will inevitably be questioned/reversed as and when the pandemic eases, and investors will have to assess the impact on various asset classes.

For equities, the two medium term key questions will be whether/if rising interest rates eventually cause equity derating/fund flow switches, government, corporate and household problems, and how the rate of corporate earnings growth develops after the initial snapback.

Following the format of last month, I make the following observations.

Observations/Thoughts

- SECTORS-The dramatic change in equity confidence, from early November, largely because of the Biden election victory and vaccine announcements prompted large sector/style changes with new focus on value, cyclicals expected to benefit from sharper economic growth. This trend has moderated somewhat in June especially after the Fed meeting. Some reflation trades lost momentum while tech stocks enjoyed a mini revival .It seems however too early to call a turn in the value/ growth relative performance trade.

- •ASSET ALLOCATION-Strategist are becoming increasingly bullish on Europe, switching some from USA (valuation, tech dominance, currency? fiscal situation) and some from Asia (last year’s story, Chinese wobbles, resurgent COVID). Although I was rather too early on this trade, I too would still recommend some tactical switching in the short term. Metrics such as PE, Yield,Price-Book,earnings growth, still look relatively inviting despite the equity outperformance so far this year ,in both local and currency adjusted terms. At the macro level, pan European deficit, currency outlook and bond market prospects are not as potentially troubling as USA. Banks, Motors, Luxury goods (both good plays on Asia), Infrastructure and Renewables would be favoured areas, and many investment trusts are currently attractive on yield and discount grounds.

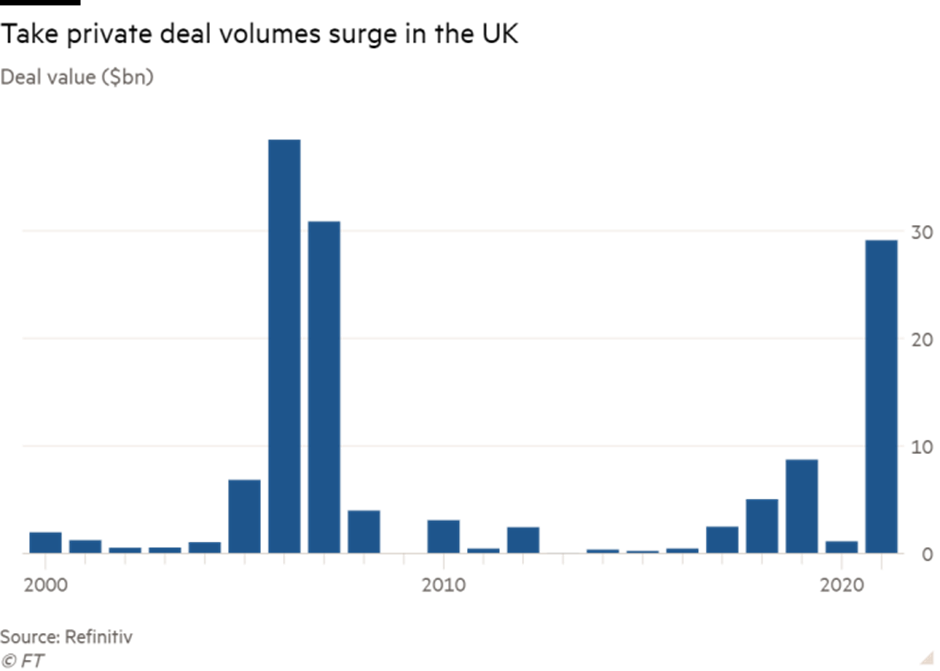

- UK Equities remain a relative overweight in my view, based on a number of conventional investment metrics, longer term underperformance since the Brexit vote, style preference (value over growth) and a vaccine/variant mix which currently supports continued economic momentum. Takeover activity is also clearly increasing with, for example, private equity snapping up UK-listed companies at the fastest pace for more than twenty years, WM Morrison being the most recent target.

-

- The divergence between my high and low risk COVID stock baskets remains high as more favourable vaccine news and economic upgrades (especially USA), have emerged. Since the 6th November turning point, the weekend of the first significant vaccine announcement and the US election, the benchmark FTSE 100, S&P and NASDAQ have all risen approximately 20%.My “balanced†basket, broadly indicative of client portfolios managed has gained about 31%.Meanwhile,over the same period, many of the “higher risk†usual suspects, IAG, Carnival, EasyJet, Cineworld and Gym Group etc have risen on average by close to 64%,although still down on pre-pandemic 2019 high prices. Conversely the defensive basket is barely showing just growth 9% appreciation and many WFH stocks have actually declined in absolute terms e.g Zoom,Peleton,Regeneron,Walmart etc

- The last months have shown the importance of maintaining a balanced portfolio. Many companies in the value/cyclical area seem likely to recover further, while great selectivity will be required chasing the Covid-19 risk stocks. Some of these names could recover quite strongly, in the longer term, but risks of bankruptcy, dilution, government interference/control should be considered. Conversely, previous†winners†must be assessed both on their relative valuation, as well as relative earnings growth in a post pandemic world. Technology, for example is a good example of an area with longer term secular growth, especially in areas such as cyber-security, cloud,AI,but shorter term valuation measures and price movement suggest that great selectively is required. Higher bond yields will also have increasingly diverse effects on equity valuations and fund flows. On varying vaccine/lockdown developments it is possible to identify sub-trends e.g staycation versus airlines.

- Emerging Markets-Very difficult to adopt a “blanket†approach to the region with so many different COVID, commodity, debt, geo-political variables. Interestingly the rush into Emerging Market assets, both bonds and equities, at the start of 2021 has moderated as many dramas have unfolded e. g Turkey, India, Ukraine. Extra due diligence is required and remember to understand the currency as well as local market dynamics.

- However, within the emerging space, I continue to have a relatively favourable view on Asia, where relative COVID success, stable FX,inward investment and export mix are supportive.Vietnam,South Korea and Taiwan continue to be favoured. The active versus passive debate in 2021, will take extra significance where “China versus the rest†and appropriate tech weighting will be important considerations. More caution is required in many South American markets with poor COVID-19 situations, deteriorating fiscal balances and inefficient governments, many of which are up for change. Parts of Central Europe are currently showing some resilience, especially when linked to German exports, but the Covid-19 situation is currently worsening in some areas.

- Not on near term investor (or government!) worry lists but be aware of the huge government DEBT problem building (tax increases sooner or later). Latest figures show aggregate global debt more than GDP at the global level and the mantra of extremely low servicing costs, is just that! Sunak recently estimated that UK’s exposure to a rise of 1 percentage point across all interest rates was approximately an additional £25 billion in debt service costs. Apart from occasional bouts of term haven buying/liability matching, I expect conventional government FIXED INTEREST to weaken in the medium term and would not be surprised to see the US 10 Year yield to trade towards 2.0% region sometime this year. Note that the US Federal Reserve slightly changed their language re tapering at their recent meeting. Closer to home, it was reported that overseas buyers snapped up £89.9 billion of gilts over the 12 months ending April 2021.However, this was still dwarfed by BoE asset purchases…which begs the future question. If/when the BoE starts to taper, and if foreign investors step back, for whatever reason, who is going to absorb £200 billion per year for the next few years?

- However, other fixed interest options are available after, making appropriate allowance for risk, transparency, trading, liquidity etc. for clients seeking regular income.

- COMMODITIES- Gold has been rangebound for a while,, and while longer term inflationary reasons and diversification benefits may apply, the prospects for more cyclical plays continue to look brighter. Interestingly the shorter-term performance of gold following the most recent Fed meeting showed an investor preference for “yielding assetsâ€. Copper, which has rallied significantly about since its March 2020 low, has benefitted from Chinese demand, “green†stimulus issues and some Covid-19 related supply issues and iron ore/coal are benefitting from a steel (especially in Asia) revival. Increased renewable initiatives, greater infrastructure spending as well as general growth, especially from Asia, are likely to keep selected commodities in demand despite Chinese efforts,through the National Development and Reform Agency,to dampen certain prices.

- Environment is expected to appear strongly on US (Biden plan), UK (November conference), and European political agendas over coming months. There are several infrastructure/renewable investment vehicles which currently appear attractive, in my view, combining well above average yields and low market correlation with low premium to asset value. However, increasing levels of due diligence are required, in committing new money to the area overall (see graph below).

- For contrarians, there are currently enormous opportunities for investors willing to lean against the ESG wave, a trend already apparent with many private equity deals, and hedge funds one of whom has been building stakes in tobacco companies.

- COMMERCIAL PROPERTY-The most recent MSCI/IPD UK Property Index up to the end of May 2021 showed a monthly total return of 1.1%(a heady 13.7% annualised!) across all properties, and a year-to-date return of 4.2%. Growth in the value of industrial assets continues to contrast with falls in office and retail. Within the retail sector, shopping centre values continued to fall, heavily weighted to in-town rather than out-of-town, while warehouse units are showing small gains. Similar trends were evident in rental growth. Continued due diligence is currently required in this sector both by asset type (direct equity, investment trust, or unit trust,) property sub-sector, and geography. Total return forecasts recently released by the IPF expect 4.4% growth in 2021 across all properties, strongly weighted to income and a provisional 7.0% figure for 2022.Anecdotal evidence from Workspace,a FTSE 250 office provider reported London rents down at least 10% and was not expecting full recovery in occupancy and rents until possibly summer 2023.A similar statement was recently made by IWG,owner of Regus. Takeover activity is emerging, the most recent being Blackstone Private Equity making an offer for St Modwem Properties PLC. M&G Property fund set to opened on 10th May, although, Aviva Property Fund has been forced to close. My current view is that investors may wish to slowly move back to a more neutral situation for he sector with my current strong preference for investment trusts rather than unit trusts.

Full asset allocation and stock selection ideas if needed for ISA/dealing accounts, pensions. Ideas for a ten stock FTSE portfolio, model pooled fund portfolios (cautious, balanced, adventurous, income now available online for DIY investors), 30 stock income lists, defensive list, hedging ideas, and a list of shorter-term low risk/ high risk ideas can also be purchased, as well as bespoke portfolio construction/restructuring and analysis of legacy portfolios.

Independence from any product provider and transparent charging structure

Feel free to contact regarding any investment project.

Good luck with performance!

Ken Baksh Bsc,Fellow (UK Society of Investment Professionals)

kenbaksh@btopenworld.com

1st July,2021